All Categories

Featured

Table of Contents

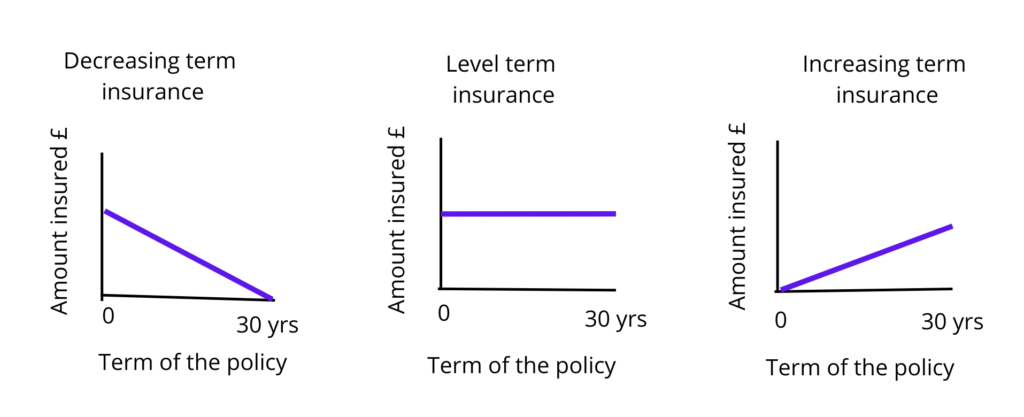

A level term life insurance coverage plan can give you peace of mind that the people who rely on you will certainly have a survivor benefit throughout the years that you are preparing to support them. It's a method to aid care for them in the future, today. A degree term life insurance policy (in some cases called level costs term life insurance policy) plan provides coverage for a set variety of years (e.g., 10 or two decades) while keeping the premium settlements the same throughout of the plan.

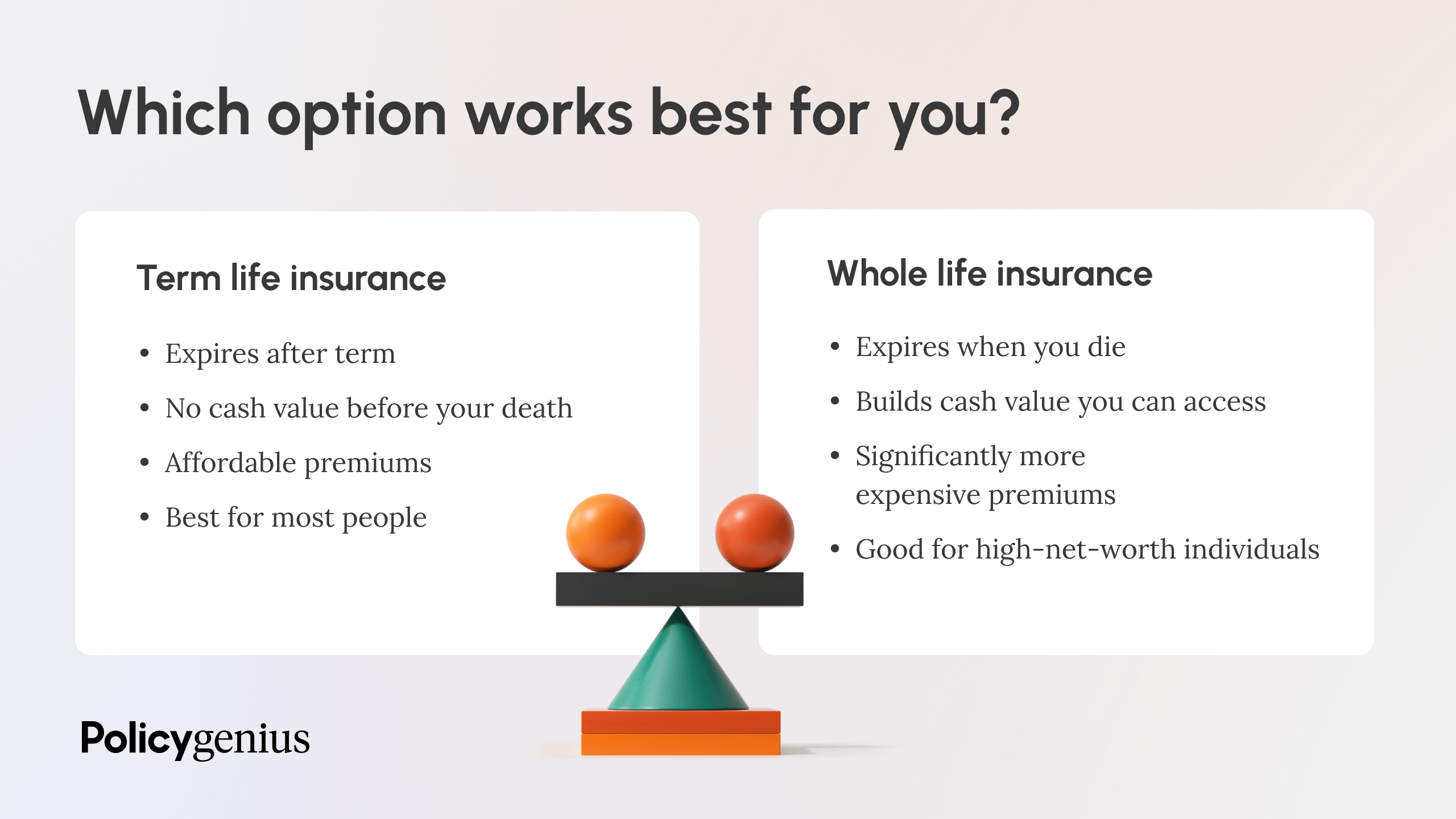

With degree term insurance policy, the price of the insurance coverage will remain the same (or potentially decrease if returns are paid) over the term of your plan, generally 10 or 20 years. Unlike permanent life insurance policy, which never ever runs out as long as you pay costs, a degree term life insurance plan will finish at some point in the future, typically at the end of the duration of your degree term.

What is Level Term Life Insurance? Learn the Basics?

Due to this, many individuals utilize irreversible insurance as a steady economic planning device that can offer several demands. You may be able to convert some, or all, of your term insurance policy throughout a set period, generally the first ten years of your policy, without needing to re-qualify for insurance coverage even if your health has actually changed.

As it does, you might intend to contribute to your insurance policy protection in the future. When you first get insurance, you may have little financial savings and a big mortgage. At some point, your savings will certainly grow and your home mortgage will reduce. As this takes place, you might intend to ultimately decrease your survivor benefit or take into consideration converting your term insurance coverage to an irreversible plan.

Long as you pay your premiums, you can rest simple knowing that your enjoyed ones will certainly get a fatality benefit if you pass away throughout the term. Lots of term plans enable you the capacity to transform to permanent insurance without having to take one more health test. This can enable you to make the most of the added benefits of a long-term plan.

Degree term life insurance policy is one of the simplest paths into life insurance policy, we'll go over the benefits and drawbacks to ensure that you can choose a strategy to fit your needs. Level term life insurance policy is the most typical and basic kind of term life. When you're seeking momentary life insurance policy strategies, level term life insurance policy is one route that you can go.

You'll fill up out an application that contains general individual information such as your name, age, and so on as well as a more in-depth questionnaire concerning your clinical background.

The short answer is no. A level term life insurance plan doesn't build cash money worth. If you're seeking to have a policy that you have the ability to withdraw or obtain from, you might check out irreversible life insurance. Whole life insurance policy plans, for instance, let you have the comfort of survivor benefit and can accumulate cash worth in time, implying you'll have more control over your advantages while you live.

What is Term Life Insurance? Pros, Cons, and Features

Cyclists are optional provisions contributed to your plan that can give you fringe benefits and securities. Bikers are a terrific way to include safeguards to your policy. Anything can happen throughout your life insurance policy term, and you desire to be prepared for anything. By paying simply a bit extra a month, cyclists can supply the assistance you need in instance of an emergency.

There are circumstances where these advantages are constructed right into your policy, however they can likewise be readily available as a different enhancement that needs extra repayment.

Latest Posts

Life Insurance Quote Online Instant

Burial Insurance Guaranteed

Omaha Burial Insurance