All Categories

Featured

Table of Contents

Finest Firm as A++ (Superior; Top category of 15). The score is as of Aril 1, 2020 and is subject to alter. MassMutual has gotten various ratings from other rating companies. Sanctuary Life And Also (Plus) is the advertising and marketing name for the And also rider, which is included as part of the Sanctuary Term policy and offers access to added services and benefits at no cost or at a price cut.

Discover a lot more in this overview. If you depend upon somebody monetarily, you could question if they have a life insurance policy policy. Find out how to find out.newsletter-msg-success,. newsletter-msg-error display: none;.

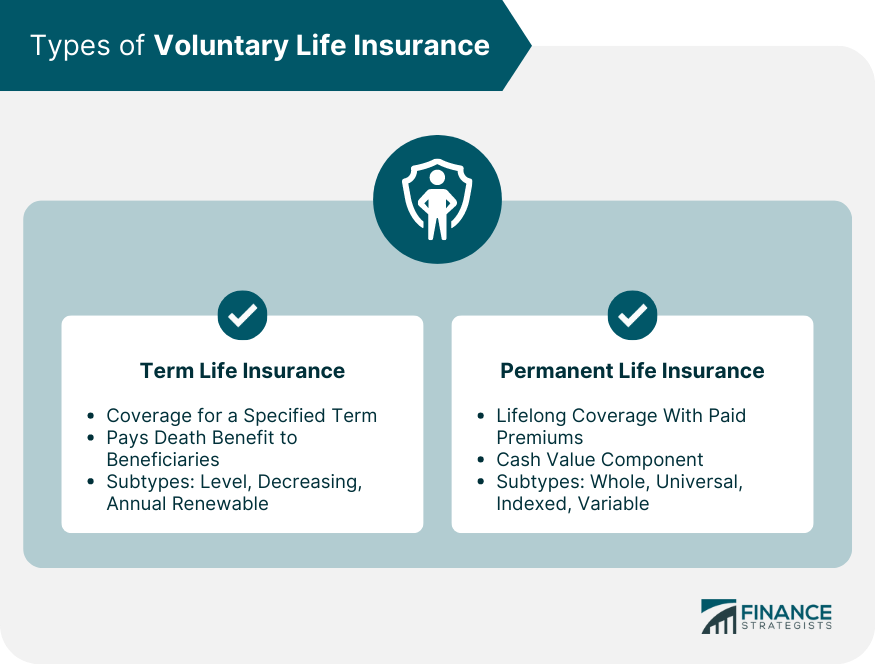

There are several kinds of term life insurance policy plans. Instead of covering you for your whole life expectancy like whole life or universal life plans, term life insurance policy only covers you for a marked period of time. Plan terms generally range from 10 to thirty years, although shorter and longer terms may be offered.

Many typically, the plan ends. If you intend to preserve coverage, a life insurance company may provide you the alternative to renew the policy for one more term. Or, your insurance provider may permit you to convert your term plan to a irreversible plan. If you added a return of costs biker to your policy, you would obtain some or all of the cash you paid in costs if you have actually outlived your term.

What is Level Term Life Insurance Companies?

Degree term life insurance policy might be the most effective option for those that desire insurance coverage for a collection time period and desire their premiums to remain steady over the term. This might put on consumers worried regarding the price of life insurance policy and those that do not wish to change their survivor benefit.

That is because term plans are not guaranteed to pay out, while irreversible policies are, provided all premiums are paid. Degree term life insurance policy is typically extra pricey than reducing term life insurance policy, where the survivor benefit reduces with time. Aside from the kind of plan you have, there are a number of other factors that help figure out the price of life insurance policy: Older applicants usually have a higher death risk, so they are typically extra costly to guarantee.

On the flip side, you may have the ability to protect a cheaper life insurance coverage price if you open the policy when you're more youthful - Level term life insurance benefits. Comparable to sophisticated age, poor wellness can additionally make you a riskier (and more expensive) prospect permanently insurance coverage. If the condition is well-managed, you may still be able to find budget-friendly insurance coverage.

Health and age are usually much even more impactful costs variables than sex. Risky hobbies, like scuba diving and sky diving, may lead you to pay even more forever insurance coverage. High-risk work, like window cleansing or tree cutting, may also drive up your expense of life insurance policy. The finest life insurance policy business and policy will certainly depend upon the person looking, their individual ranking elements and what they need from their plan.

Is Level Term Life Insurance Protection worth it?

The very first step is to establish what you need the policy for and what your budget is. Some business provide online quoting for life insurance policy, yet several need you to contact an agent over the phone or in individual.

The most preferred kind is now 20-year term. Most business will certainly not sell term insurance policy to an applicant for a term that ends past his/her 80th birthday. If a plan is "eco-friendly," that means it continues active for an added term or terms, approximately a specified age, also if the wellness of the guaranteed (or various other variables) would create him or her to be turned down if she or he requested a brand-new life insurance policy plan.

So, premiums for 5-year eco-friendly term can be degree for 5 years, after that to a brand-new rate mirroring the brand-new age of the insured, and more every 5 years. Some longer term plans will guarantee that the costs will not boost during the term; others do not make that assurance, allowing the insurance policy firm to elevate the price during the plan's term.

This means that the policy's owner deserves to transform it right into a permanent sort of life insurance policy without extra evidence of insurability. In the majority of kinds of term insurance policy, consisting of house owners and vehicle insurance, if you have not had a case under the policy by the time it expires, you get no reimbursement of the costs.

How do I choose the right Level Term Life Insurance Quotes?

Some term life insurance coverage consumers have been dissatisfied at this result, so some insurance companies have produced term life with a "return of premium" feature. The costs for the insurance coverage with this function are usually considerably more than for plans without it, and they typically need that you maintain the plan in pressure to its term or else you forfeit the return of premium benefit.

Degree term life insurance policy premiums and fatality benefits continue to be consistent throughout the policy term. Degree term life insurance policy is normally more economical as it does not build money value.

While the names usually are utilized mutually, degree term coverage has some essential distinctions: the costs and death benefit stay the very same throughout of insurance coverage. Level term is a life insurance policy plan where the life insurance policy premium and fatality advantage continue to be the same for the duration of protection.

These plans can last for a 10-year term, 15-year term, 20-year term or 30-year term. The size of your protection period may depend on your age, where you remain in your profession and if you have any type of dependents. Like other kinds of life insurance protection, a level term plan offers your beneficiaries with a survivor benefit that's paid if you die during your insurance coverage period.

What is the process for getting Level Term Life Insurance Policy?

Some term plans may not keep the costs and death profit the very same over time. You do not want to erroneously think you're acquiring degree term coverage and after that have your fatality benefit modification later on.

Or you might have the option to convert your existing term insurance coverage right into a permanent policy that lasts the rest of your life. Numerous life insurance coverage plans have possible advantages and downsides, so it's vital to recognize each prior to you make a decision to buy a plan.

Latest Posts

Life Insurance Quote Online Instant

Burial Insurance Guaranteed

Omaha Burial Insurance